The Canadian Privacy Law Blog: Developments in privacy law and writings of a Canadian privacy lawyer, containing information related to the Personal Information Protection and Electronic Documents Act (aka PIPEDA) and other Canadian and international laws.

Recent Posts

- This blog has moved

- Some thoughts on street photography

- RCMP changes rules for criminal records checks

- Saskatchewan amends privacy regs to permit solicia...

- US Federal judge declares warrantless wiretapping ...

- Commisser releases discussion paper on cloud compu...

- Heathrow worker given police warning for body scan...

- How Privacy Vanishes Online, a Bit at a Time

- Facebook plans to allow users to "share" location

- Drawing the curtain on ISP cooperation with law en...

On Twitter

About this page and the author

The author of this blog,

David T.S. Fraser, is a Canadian privacy lawyer who practices with the

firm of McInnes Cooper. He is the author of the Physicians' Privacy Manual. He has a national and international practice advising corporations and individuals on matters related to Canadian privacy laws.

The author of this blog,

David T.S. Fraser, is a Canadian privacy lawyer who practices with the

firm of McInnes Cooper. He is the author of the Physicians' Privacy Manual. He has a national and international practice advising corporations and individuals on matters related to Canadian privacy laws.

For full contact information and a brief bio, please see David's profile.

Please note that I am only able to provide legal advice to clients. I am not able to provide free legal advice. Any unsolicited information sent to David Fraser cannot be considered to be solicitor-client privileged.

Privacy Calendar

Archives

- January 2004

- February 2004

- March 2004

- April 2004

- May 2004

- June 2004

- July 2004

- August 2004

- September 2004

- October 2004

- November 2004

- December 2004

- January 2005

- February 2005

- March 2005

- April 2005

- May 2005

- June 2005

- July 2005

- August 2005

- September 2005

- October 2005

- November 2005

- December 2005

- January 2006

- February 2006

- March 2006

- April 2006

- May 2006

- June 2006

- July 2006

- August 2006

- September 2006

- October 2006

- November 2006

- December 2006

- January 2007

- February 2007

- March 2007

- April 2007

- May 2007

- June 2007

- July 2007

- August 2007

- September 2007

- October 2007

- November 2007

- December 2007

- January 2008

- February 2008

- March 2008

- April 2008

- May 2008

- June 2008

- July 2008

- August 2008

- September 2008

- October 2008

- November 2008

- December 2008

- January 2009

- February 2009

- March 2009

- April 2009

- May 2009

- June 2009

- July 2009

- August 2009

- September 2009

- October 2009

- November 2009

- December 2009

- January 2010

- February 2010

- March 2010

- April 2010

Links

Blogs I Follow

Small Print

The views expressed herein are solely the author's and should not be attributed to his employer or clients. Any postings on legal issues are provided as a public service, and do not constitute solicitation or provision of legal advice. The author makes no claims, promises or guarantees about the accuracy, completeness, or adequacy of the information contained herein or linked to. Nothing herein should be used as a substitute for the advice of competent counsel.

This web site is presented for informational purposes only. These materials do not constitute legal advice and do not create a solicitor-client relationship between you and David T.S. Fraser. If you are seeking specific advice related to Canadian privacy law or PIPEDA, contact the author, David T.S. Fraser.

Tuesday, January 20, 2009

Heartland data breach could be bigger than TJX's

Heartland Payment Systems has announced that it suffered a significant data breach last year after it was discovered that hackers had installed software on their systems to capture credit card information. The firm apparenly processes over 100 Million tranactions a month, leading to speculation that this may dwarf the 2007 TJX breach. See: Heartland data breach could be bigger than TJX's.

Labels: breach notification, information breaches, privacy, tjx

Tuesday, August 05, 2008

Charges following TJX breach investigation

The New York Times is reporting that 11 people have been charged in connection with the massive data breach that dominated the headlines for months after January 2007:

11 Charged in Theft of 40 Million Card Numbers - NYTimes.comFor the sordid history, see these related posts....The charges focus on three people from the United States, three from the Ukraine, two from China, one from Estonia and one from Belarus.

The authorities said that the scheme was spearheaded by a Miami man named Albert Gonzalez, who hacked into the computer systems of retailers including TJX, BJ’s Wholesale Club, OfficeMax, Boston Market, Barnes & Noble, Sports Authority, Forever 21 and DSW Inc. The numbers were then stored on computer servers in the United States and Eastern Europe.

They then sold the information to people in the United States and Europe, who used it to withdraw tens of thousands of dollars at a time from automated teller machines, the authorities said....

Thursday, April 03, 2008

TJX reaches tentative settlement with MasterCard

Shamed retailer TJX has reached a tentative settlement with MasterCard to the tune of $24 million, according to the Associated Press:

The Associated Press: TJX Could Pay Another $24M for BreachBOSTON (AP) — Discount retailer TJX Cos. could pay as much as $24 million in a settlement Wednesday with MasterCard Inc. over a massive breach that exposed tens of millions of payment card numbers to hackers.

The pact came as a group that tracks U.S. data breaches reported the number of cases in the first three months of this year was more than double the total in last year's first quarter.

The TJX agreement, which follows a similar $40.9 million pact in November with Visa Inc., hinges on banks that issue MasterCards agreeing to waive rights to sue TJX in exchange for being paid for breach-related costs.

Issuers of at least 90 percent of the MasterCard accounts identified as possibly being compromised in the breach must approve the agreement by May 2 for the settlement to take effect, Purchase, N.Y.-based MasterCard and Framingham, Mass.-based TJX said in separate news releases.

In the Visa agreement, TJX won consent from more than 95 percent of Visa issuers within three weeks after the deal was announced Nov. 30. That agreement required 80 percent approval, rather than the MasterCard agreement's 90 percent threshold.

TJX President and Chief Executive Carol Meyrowitz said her company believes the latest agreement "provides a fair resolution for MasterCard and its issuing banks."

...

Sunday, December 30, 2007

TJX creates executive jobs to deal with privacy issues

In the better late than never department: TJX creates executive jobs to deal with privacy issues - The Boston Globe. (Thanks to Pogo for the link.)

Saturday, December 29, 2007

The 2007 Security Hall of Shame

Another "year in review" ... this time the Computerworld nominees to the security hall of shame:

The 2007 Security Hall of ShameA brace of breaches: 2007's five worst

In a league of its own: The TJX Companies Inc.

The U.K.'s VA: HMRC misplaces records on 25 million kids In November

The system was broken brokered: Fidelity National Information Services

Some honor among thieves: TD Ameritrade Holding Corp. Brokerage firm Ameritrade

Creatures from the hack lagoon: Monster.com

Ummm ... oops?

Notable meltdowns

Do you copy?: DHS's self-created DDoS attack

Bag that: Supervalu gets phished

Undiplomatic relations: Symantec in China

Hear me, see me: House outs whistle-blowers

Arrrrr! WGA sees pirate people

... and your 2007 poster boys

Consultant turns bot herder: John Schiefer

Exit strategy: Gary Min

Don't drop the soap: Ivory Dickerson

Unbirthday boy: Yung-Hsun Lin

Pick a hat already: Maxwell Butler

Labels: 2007 in review, homeland security, privacy, tjx

Sunday, December 02, 2007

TJX Agrees to Pay $40.9 Million to Visa Card Issuers

According to the New York Times, TJX has agreed to settle claims brought against it by Visa card issuing banks if they accept the offer by December 19. Claims will be paid by year end. See: TJX Agrees to Pay $40.9 Million to Visa Card Issuers - New York Times.

Wednesday, September 26, 2007

Inadequate security safeguards led to TJX breach, Commissioners say

The federal Privacy Commissioner and the Information and Privacy Commissioner of Canada have released their reports on the TJX/Winners breach (Report of Findings (September 25, 2007) Privacy Commissioner of Canada and Investigation Report P2007-IR-006). The moral of the story: don't collect information you don't need, don't keep it any longer than you need and properly secure the information you have.

Here's the media release:

News Release: Inadequate security safeguards led to TJX breach, Commissioners say (September 25, 2007) - Privacy Commissioner of CanadaInadequate security safeguards led to TJX breach, Commissioners say

September 25, 2007 –The risk of a breach of sensitive personal information held by TJX Companies Inc., the US parent company of Winners and HomeSense stores in Canada, was foreseeable, but the company failed to put in place adequate security safeguards, an investigation by the Privacy Commissioners of Canada and Alberta has found.

“The company collected too much personal information, kept it too long and relied on weak encryption technology to protect it – putting the privacy of millions of its customers at risk,” says Privacy Commissioner of Canada Jennifer Stoddart.

“Criminal groups actively target credit card numbers and other personal information,” says Commissioner Stoddart. “A database of millions of credit card numbers is a potential goldmine for fraudsters and it needs to be protected with solid security measures.

“The TJX breach is a dramatic example of how keeping large amounts of sensitive information – particularly information that is not required for business purposes – for a long time can be a serious liability.”

The joint investigation by the two Commissioners was launched after TJX disclosed in January that its computer system had been breached. This breach involved millions of credit and debit card numbers as well as other personal information, such as driver’s license numbers collected when customers returned merchandise without receipts.

“This case is a wake-up call for all retailers. They must collect only the personal information necessary for a transaction,” says Frank Work, the Information and Privacy Commissioner of Alberta.

“One positive outcome of this extremely unfortunate breach is that TJX worked cooperatively with us to develop a new process for dealing with unreceipted returns which strikes an appropriate balance between privacy rights and a retailer’s need to take steps to prevent fraud.”

TJX believes the intruder may have initially gained to customer information via the wireless local area networks at two of its US stores. Customer information was stolen from mid-2005 through December 2006, a TJX investigation found. Some stolen information involved transactions dating back to 2002.

Stolen information included credit card account data as well as data collected when customers returned merchandise without a receipt (drivers’ license numbers, names and addresses).

The investigation concluded TJX did not comply with the federal private sector privacy law, the Personal Information Protection and Electronic Documents Act (PIPEDA), and Alberta’s Personal Information Protection Act (PIPA). The investigation found:

- TJX did not properly manage the risk of an intrusion against the amount of customer data that it collected.

- The company failed to act quickly in converting from a weak encryption standard to a stronger standard. The conversion process took two years to complete, during which time the breach occurred.

- TJX did not meet its duty to monitor its computer systems vigorously. An adequate monitoring system should have alerted the company of an intrusion prior to December 2006.

- The company did not adhere to the requirements of the Payment Card Industry Data Security Standard, which was developed to address the growing problem of credit card data theft.

The investigation also found the company did not have a reasonable purpose to collect driver’s license and other identification numbers when unreceipted merchandise was returned. TJX stated it asked for this information as part of a fraud prevention process to identify people frequently returning merchandise. It retained the driver’s license numbers – an extremely valuable piece of information for identity thieves – indefinitely.

In response to these concerns, TJX proposed a new process to address fraudulent returns. Store staff will continue to ask for identification, however, information such as a driver’s license number will instantly be converted into a unique identifying number when it is keyed into the point-of-sale system. This will allow the company to track unreceipted merchandise returns without keeping original driver’s license numbers in its system.

The Commissioners called on TJX to take a number of steps to improve its security measures and privacy practices and are pleased the company has agreed to follow these recommendations.

Commissioner Stoddart says the Winners/HomeSense breach illustrates the need to get security right in the first place to avoid the potentially huge costs of mopping up after a security breach. “Organizations need to ensure they have multiple layers of security and that they keep up with advances in security technologies. The cost of failing to do this can be enormous – not only to a company, but to its customers,” she says, adding that a data breach can also have a major impact on credit card companies, banks, law enforcement agencies and regulatory bodies.

A summary of the findings in the case is available on the Commissioners’ websites.

The Privacy Commissioner of Canada is mandated by Parliament to act as an ombudsman, advocate and guardian of privacy and the protection of personal information rights of Canadians.

The Information and Privacy Commissioner of Alberta has a mandate to promote a society where personal privacy is respected and public bodies are open and accountable.

Monday, September 24, 2007

Federal and Alberta Commissioners to release report on TJX breach

According to a media advisory released by the Privacy Commissioner of Canada, both the federal and Alberta commissioners are going to release their findings on the TJX/Winners/Home Sense privacy breach tomorrow morning in Montreal. See: Media Advisory: September 24, 2007 - Privacy Commissioners to release report on Winners/HomeSense breach - Privacy Commissioner of Canada.

Friday, August 03, 2007

Federal Privacy Commissioner releases privacy breach guidelines

The Federal Privacy Commissioner has just released privacy breach guidelines, which are similar to guidelines produced by the Ontario and British Columbia commissioners. Here is the press release, with links to the guidelines:

News Release: Privacy Commissioner releases privacy breach guidelines (August 1, 2007) - Privacy Commissioner of CanadaPrivacy Commissioner releases privacy breach guidelines

Ottawa, August 1, 2007 – New guidelines will help organizations take the right steps after a privacy breach, including notifying people at risk of harm after their information has been stolen, lost or mistakenly disclosed, says the Privacy Commissioner of Canada, Jennifer Stoddart.

The guidelines outline some of the key steps in responding to a breach, such as containing the breach, evaluating the risks associated with it, notifying the people affected and preventing future breaches.

“It’s clear that most businesses take seriously their responsibilities under Canada’s private-sector privacy law. I want to thank the industry groups, civil societies groups and privacy commissioners' offices that helped my office in developing these,” Commissioner Stoddart says.

The Office of the Privacy Commissioner (OPC) has become increasingly concerned about privacy breaches and breach notification following some major data breaches in recent months. Earlier this year, Commissioner Stoddart urged the federal government to amend the Personal Information Protection and Electronic Documents Act (PIPEDA) to make it mandatory for businesses to notify people when their personal information has been breached.

“Our new voluntary guidelines do not take away from the need for breach notification legislation,” the Commissioner says. “I would once again urge the Minister of Industry and his cabinet colleagues to help better protect Canadians by making breach notification a legal requirement for businesses.” The guidelines call on businesses to notify people that their personal information has been compromised in cases where the breach raises a risk of harm. For example, there may be a risk of identity theft or fraud in cases where sensitive personal information has been lost or stolen.

Organizations are also encouraged to inform the appropriate privacy commissioner(s) of a privacy breach. (In British Columbia, Alberta and Quebec, provincially regulated businesses should speak to their provincial privacy commissioners. In Ontario, breaches involving personal health information must be reported to the provincial commissioner.)

The OPC is currently investigating two high-profile privacy breach cases involving large amounts of personal information.

In one case, the Canadian Imperial Bank of Commerce reported to the OPC the disappearance of a hard drive containing the personal information and financial data of close to half a million clients of its subsidiary, Talvest Mutual Funds.

The other investigation, being conducted jointly with the Information and Privacy Commissioner of Alberta, is looking at a breach at TJX Companies Inc., which affected thousands of Canadians who shopped at TJX’s Winners and HomeSense stores.

The new guidelines as well as a privacy breach checklist and a list of organizations which participated in the consultation process to develop the guidelines are available on the OPC website, http://www.privcom.gc.ca/.

The Privacy Commissioner of Canada is mandated by Parliament to act as an ombudsman, advocate and guardian of privacy and the protection of personal information rights of Canadians.

Labels: alberta, bc, breach notification, british columbia, health information, identity theft, privacy, tjx

Thursday, July 05, 2007

Lessons to learn from TJX

David Canton has posted a link to a great article from the McLean Report, which is usually limited to subscribers but he has obtained permission to post it on his site. Check it out: Lessons Learned from TJX: Protect Customer Data at all Costs: eLegal Canton.

Monday, May 07, 2007

WSJ sheds light on TJX breach methods

David Canton has just posted a link to a very interesting and insightful article on the TJX/Winners breach, which sheds light on how the scammers were able to penetrate the TJX system to take approximately TWO HUNDRED MILLION credit card numbers.

How Credit-Card Data Went Out Wireless Door - WSJ.com... When wireless data networks exploded in popularity starting around 2000, the data was largely shielded by a flawed encoding system called Wired Equivalent Privacy, or WEP, that was quickly pierced. The danger became evident as soon as 2001, when security experts issued warnings that they were able to crack the encryption systems of several major retailers.

By 2003, the wireless industry was offering a more secure system called Wi-Fi Protected Access or WPA, with more complex encryption. Many merchants beefed up their security, but others including TJX were slower to make the change. An auditor later found the company also failed to install firewalls and data encryption on many of its computers using the wireless network, and didn't properly install another layer of security software it had bought. The company declined to comment on its security measures.

The hackers in Minnesota took advantage starting in July 2005. Though their identities aren't known, their operation has the hallmarks of gangs made up of Romanian hackers and members of Russian organized crime groups that also are suspected in at least two other U.S. cases over the past two years, security experts say. Investigators say these gangs are known for scoping out the least secure targets and being methodical in their intrusions, in contrast with hacker groups known in the trade as "Bonnie and Clydes" who often enter and exit quickly and clumsily, sometimes strewing clues behind them.

The TJX hackers did leave some electronic footprints that show most of their break-ins were done during peak sales periods to capture lots of data, according to investigators. They first tapped into data transmitted by hand-held equipment that stores use to communicate price markdowns and to manage inventory. "It was as easy as breaking into a house through a side window that was wide open," according to one person familiar with TJX's internal probe. The devices communicate with computers in store cash registers as well as routers that transmit certain housekeeping data.

After they used that data to crack the encryption code the hackers digitally eavesdropped on employees logging into TJX's central database in Framingham and stole one or more user names and passwords, investigators believe. With that information, they set up their own accounts in the TJX system and collected transaction data including credit-card numbers into about 100 large files for their own access. They were able to go into the TJX system remotely from any computer on the Internet, probers say....

Labels: cardsystems, privacy, retail, security, tjx

Thursday, March 29, 2007

TJX: At least 45.7M card numbers stolen

Sorry for the light blogging for the last little while. Busy times at work, two family weddings and March break for the kids intervened. But I'm back.

The Associated Press is reporting that TJX has disclosed that their recent breach compromised 45.7 million credit and debit card numbers (including mine). The breach went on for eighteen months and the card information the company had on file dated as far back as December 2002. See: TJX: At least 45.7M card numbers stolen - Yahoo! News.

Friday, March 16, 2007

FTC investigating TJX, Winners parent company

This really shouldn't be a big surprise:

FTC Launches Investigation Of T.J. Maxx Parent Company - Yahoo! NewsThe U.S. Federal Trade Commission Tuesday confirmed that it has launched an investigation of TJX, the parent company of T.J. Maxx, Marshalls, HomeGoods, and other stores. While the FTC wouldn't reveal the nature of the investigation or when it began, it's likely the result of a large data breach that allowed cyberintruders to steal customer data.

Should TJX be worried? During the past few years, ChoicePoint showed everyone just how much power the FTC wields. That company wound up paying $10 million in civil penalties and $5 million in customer redress after it handed over consumers' names, addresses, Social Security numbers, and credit reports to fraudsters working out of Los Angeles County. But the monetary penalty is just the beginning, says Jo Anne Adlerstein, an attorney with Thelen Reid Brown Raysman & Steiner LLP. ChoicePoint also had to implement a new IT security system, and their security systems will be audited every two years for the next 20 years. If TJX is found to be in violation of privacy laws, "it will be the beginning of an ongoing relationship with the FTC," she says.

The FTC's investigation of TJX should put all companies that handle customer data on notice. "Companies must think in terms of, 'What if the FTC stops by to see me tomorrow? What will they find?'" Adlerstein says....

Thursday, March 01, 2007

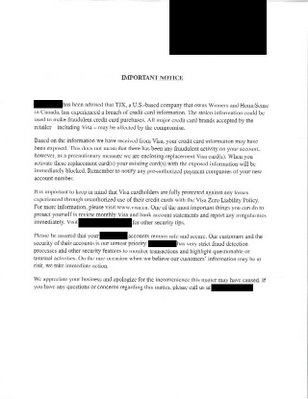

This time it's personal

In addition to my weekly New Yorker magazine, today's mail contained a plain envelope with a PO Box return address. From a mile away, I could tell it was a credit card. Like many people recently, my bank has sent me a new credit card in the mail because I shopped at Winners. According to the letter, there is reason to believe my credit card was compromised in the Winners/TJX breach. The form letter tells me that there's been no evidence of fraudulent activity, but this is just in case.

When the TJX story broke, I attempted to contact their privacy officer through the address on the website. What I was looking for was a fax number becuase I did not want to communicate with them, particularly about my credit card, via e-mail. That was months ago and no contact and no reply. Not impressive.

I just went to the Winners website and tried to check out their IMPORTANT CUSTOMER ALERT, which connects (or rather doesn't connect) to a TJX server:

Less impressive.

Going directly to the TJX website provided a working link:

As TJX’s President and Chief Executive Officer, I want our customers to know how much I personally regret any difficulties you may experience as a result of the unauthorized intrusion into our computer systems. We are working with leading computer security firms to investigate the problem and enhance our computer security in order to protect our customers’ data. We are dedicating significant resources to evaluate the issue. Given the nature of the breach, the size and international scope of our operations and the complexity of the way credit card transactions are processed, the evaluation is, by necessity, taking time.Since we learned of the probability of a breach in mid-December 2006, we have cooperated with law enforcement as well as with the banks and credit card companies that process our customer transactions. Further, we have established customer helplines in three countries and are making available a great deal of helpful information on our company websites.

We are committed to continue to address the situation and to provide periodic updates as we learn more. We have reported updated information in a press release which you will find below.

Additionally, I encourage you to access the information we are providing on this website to learn more about steps you can take to protect your credit and debit card information, or to contact our special customer helplines.

With the help of computer security experts, we have strengthened the security of our computer systems and we believe customers should feel safe shopping in our stores. We value the trust our customers place in us and again, I’d like you to know that we sincerely apologize for any difficulties you may be caused. Thank you for continuing to shop at our stores and for your years of loyal patronage.

Respectfully,

Carol Meyrowitz

President and Chief Executive Officer

Those affected may seek some perverse comfort that TJX may face significant penalties under the PCI Data Security Standard.

It will be interesting (but certainly not remedial in any way) to see what the Privacy Commissioner concludes about this investigation.

Labels: cardsystems, privacy, tjx

Wednesday, February 21, 2007

T.J. Maxx probe finds broader hacking

This isn't good:

T.J. Maxx probe finds broader hacking | Tech News on ZDNetThe TJX Companies, the discount retailer best known for its T.J. Maxx and Marshalls clothing stores, said Wednesday that its hacking investigation has uncovered more extensive exposure of credit and debit card data than it previously believed.

Information on millions of TJX customers may have been exposed in the long-running attack, which was made public last month. It affects customers of any of TJX store in the U.S., Canada or Puerto Rico, with the exception of its Bob's Stores chain.

The breach of credit and debit card data was initially thought to have lasted from May 2006 to January. However, TJX said Wednesday that it now believes those computer systems were first compromised in July 2005.

TJX said credit and debit card data from January 2003 through June 2004 was compromised. The company previously said that only 2003 data may have been accessed. According to TJX, however, some of the card information from September 2003 through June 2004 was masked at the time of the transactions.

The company added that names and addresses apparently were not included with the card information, that debit card PIN numbers are not believed to have been vulnerable, and that data from transactions made with debit cards issued by Canadian banks likely were not vulnerable.

TJX also found that there was evidence of intrusion into the system that handles customer transactions for its T.K. Maxx stores in the United Kingdom and Ireland, but that there has been no confirmation that anyone actually accessed that data.

In addition to these exposures, TJX said there were more breaches of driver's license information than it previously thought. These included the license numbers, names and addresses of customers making merchandise returns in the U.S. and Puerto Rico locations of T.J. Maxx, Marshalls and HomeGoods stores. That compromised data, according to TJX, is restricted to returns without receipts that took place in the last four months of 2003, as well as in May 2004 and June 2004.

TJX plans to notify customers whose driver's license data may have been accessed.

The company, which is continuing its investigation, encourages customers to check their credit-card and bank-account records and look for further updates on its website.

Labels: cardsystems, privacy, retail, tjx

Thursday, February 08, 2007

Finding the smoking gun in security breaches

In most cases of fraud following a security breach, the biggest problem for consumers seeking a remedy is proving the connection between the breach and the ensuing fraud. According to CIO Blogs, the TJX breach is different and a small bank in New England has made the connection. It has found the smoking gun and says it will seek damages against the company.

This may be the wakeup call that will force companies to be more diligent about security. See: CIO Blogs - The TJX security breach. This one's different. Way different. |.

Thanks to John Gregory for the link.

Labels: fraud, identity theft, privacy, tjx, tort

Sunday, February 04, 2007

Consumer response and responsibility

Dissent, at the Chronicles of Dissent (part of Pogowasright) asks whether consumer stupidity plays a role in privacy breaches and the response. Dissent points to an article from my local newspaper, the Chronicle Herald, quoted below.

I can't say that Canadians are more prudent or insistent about their privacy than our cousins below the border, or more stupid. In my experience on the east coast of Canada, most folks around here are much more trusting of the companies they do business with. The cynicism from down south hasn't quite permeated this neck of the woods. One thing we generally are more tolerant of is government regulation, such as that governing privacy.

We have not yet seen any provinces or the federal government come up with mandatory breach notification, with the narrow exception contained in Ontario's health privacy law. In that regard, we are lagging behind most of the states in the US.

Winners reassures CanadiansSecurity breach did not involve cards issued north of border, says retailer

By AMANDA-MARIE QUINTINO The Canadian Press

TORONTO — Assurances from Winners and HomeSense that a security breach reported last month did not involve Canadian debit-card transactions isn’t making much of dent with customers of the two retail chains.

Not much can keep them from their bargain hunting.

The deals to be found at Winners makes the risk of becoming the victim of credit card fraud worthwhile, said Sherry Croney as she slowly sifted through the blouse racks at one of the chain’s cavernous stores in downtown Toronto.

Croney said she never uses her credit card when clothes shopping, and even if she did, a security breach wouldn’t stop her.

...

"Our computer security experts have now completed their investigation of the portion of our computer network that handles Winners and HomeSense transactions, and they have advised us that they do not believe that debit cards issued by Canadian banks were compromised in the intrusion," said a TJX statement posted on the Winners website.

I note there is only a reference to Canadian debit cards.... nothing said about credit cards.

Labels: breach notification, privacy, retail, tjx

Saturday, January 27, 2007

Will this be beginning of breach notification in Canada?

The recent personal information breaches in Canada have prompted a lot of discussion about breach notification.

This may be the upswell of citizen concern that will prompt legislative change in Canada. From today's Halifax Chronicle Herald:

The ChronicleHerald.ca - Should retailers come clean? Businesses not obligated to alert consumers when information is stolenBy CLARE MELLOR Business Reporter

Retailers and financial institutions in Canada don’t have to tell customers when thieves have stolen their personal information.

Recent cases of data theft at Winners and the loss of a hard drive at CIBC have made headlines across the country, alerting Canadian consumers to be on guard for identity theft, but these security breaches could be the tip of the iceberg, privacy experts say.

"There are probably a whole lot more incidents out there that we haven’t heard about because the businesses have no legal reason that requires them to tell the consumers involved," Halifax lawyer David Fraser, a privacy specialist, said Friday.

"One of the big questions on law reform in this area is whether a business should have a duty to notify people whose information has been compromised."

CIBC, which was earlier taken to task by federal privacy commissioner Jennifer Stoddart for lapses in security involving misdirected faxes, issued a news release and sent letters to Talvest mutual-fund holders last week. The company said a backup computer file containing their personal information had gone missing in transit.

TJX Cos., American operator of Winners and HomeSense, recently revealed that computer hackers had broken into its system, but the firm has not said how many customers had personal data stolen.

About 30 states have laws requiring businesses to notify their customers when their personal information has been stolen or lost, Mr. Fraser said.

A parliamentary committee has been reviewing Canada’s federal privacy law. Requirements to notify the public when a breach happens are being discussed.

When Ms. Stoddart appears before the committee, she will likely call for changes to the law requiring businesses to inform consumers when their information has been stolen or gone missing, Anne-Marie Hayden, spokeswoman for the privacy commissioner’s office, said Friday.

Under Canada’s privacy law, businesses and banks must keep personal information secure and not share it without client consent.

While Ms. Stoddart’s office can’t fine or penalize businesses that repeatedly break the law, it can pursue legal action through the Federal Court, Ms. Hayden said.

"It would be safe to say that most of the time when the commissioner makes recommendations (to tighten privacy practices), those changes are implemented," she said .

But David Malamed, a forensic accountant, said it is clear many companies are not taking their privacy obligations seriously enough.

"A lot of the reason that it is happening is that the focus for a lot of companies is on the bottom line," said Mr. Malamed, who works at Grant Thornton in Toronto

"As systems advance, people get smarter and the question is how money is being invested into protecting these systems. . . . There are different methods that you can go about to protect your customer information that will help prevent this from happening or at least reduce it to a greater degree."

There have been media reports of fraudulent purchases made with customer information stolen from Winners.

A Canadian law firm, Merchant Law Group, which has offices in Saskatchewan and Alberta, has already launched a class-action suit over the security breach.

But there is some question about whether Canadian consumers can successfully sue for theft or mishandling of their personal information, Mr. Fraser said.

"If you are the subject of fraud, you may be able to successfully sue them," he said. "But if you can’t prove harm, it is much more difficult."

(cmellor@herald.ca)

Labels: alberta, breach notification, identity theft, pipeda review, privacy, tjx

Monday, January 22, 2007

A call for Canadian breach notification

Michael Geist's latest Law Bytes column in the Toronto Star presses the case for mandatory breach notification in the wake of the recent TJX and CIBC privacy breaches. See: Michael Geist - Privacy Breaches Expose Flaws in Law.

Labels: breach notification, privacy, tjx

Thursday, January 18, 2007

Incidents: Rash of info breaches with Canadian connections

This has been a crazy week for privacy breaches in Canada and the week isn't over yet. I can't recall the last time I had so many media inquiries.

In addition to those below, I've been asked about two other incidents that will likely break in the next few days. (Since I heard about them from journalists, it would be rude to scoop them on the blog.)

Today we've heard of a significant announcement made by Talvest Mutual Funds

Talvest Mutual Funds issues statement regarding missing back up computer fileMONTREAL, Jan. 18 /CNW/ - Talvest Mutual Funds today announced that a backup computer file containing client information has recently gone missing while in transit between its offices.

The backup file contained information relating to the process used to open and administer approximately 470,000 current and former Talvest client accounts and may have included client names, addresses, signatures, date of birth, bank account numbers, beneficiary information and / or Social Insurance Numbers. Talvest has retained original copies of their files on its secure website.

While Talvest has no evidence to suggest this backup file has been inappropriately accessed, the manager of Talvest Mutual Funds, CIBC Asset Management, has taken precautionary measures to protect its clients. These actions include:

- Notifying all affected clients by letter.

- Compensating any affected Talvest clients for monetary loss that arises directly from unauthorized access of personal information contained on this file.

- Providing affected Talvest clients the opportunity to enrol in a credit monitoring service at no cost. This service will provide added security on client credit files at major Credit Reporting agencies.

- Establishing a dedicated call centre and website to deal with any affected Talvest client inquiries.

- Advising affected Talvest clients to regularly review activity on all their financial accounts and report any unauthorized activity immediately to their financial institution.

- Working with the police to investigate this incident and retrieve this backup file.

"We are in the process of contacting affected Talvest clients by letter to advise them of this issue and to detail the steps we are taking to safeguard their information," said Steve Geist, President of CIBC Asset Management. "Although, we have no evidence that the information contained in the backup file has been accessed in any way, we are acting out of an abundance of caution and want to assure our clients that we are taking all steps possible to address this matter. Any issue that causes disruption to our clients is of great concern to us and we regret the inconvenience this may cause our Talvest Mutual Fund Clients."

For more information on this matter, Talvest Mutual Fund clients are advised to visit www.talvest.com.

And with a report from the CBC:

CIBC loses data on 470,000 Talvest fund customersCIBC Asset Management says a backup computer file containing information on almost half a million of its Talvest Mutual Funds clients has gone missing.

The company says the missing data was in a file that disappeared "while in transit between our offices." The file had personal and financial details on current and former clients of Talvest Mutual Funds, which is a CIBC subsidiary.

The information may have included client names, addresses, signatures, dates of birth, bank account numbers, beneficiary information and/or Social Insurance Numbers.

Talvest says there's no indication that the missing backup file has been "inappropriately accessed," but says CIBC will be taking a number of precautions.

"We are in the process of contacting affected Talvest clients by letter to advise them of this issue and to detail the steps we are taking to safeguard their information," said Steve Geist, president of CIBC Asset Management.

Computer fraud expert Thomas Keenan from the University of Calgary said there's good reason for the company to alert their customers. "Because what's on there [the missing file] is everything you need to know to do identity theft," he told CBC News.

The privacy commissioner of Canada, Jennifer Stoddart, announced that she is launching an investigation.

"Although I appreciate that the bank notified us of this incident and that it is working co-operatively with my office, I am nevertheless deeply troubled, especially given the magnitude of this breach, which puts at risk the personal information of hundreds of thousands of Canadians," Stoddart said in a statement.

Talvest has set up special phone lines for clients who want more information.

The report follows news of a potential corporate privacy breach that could affect as many as two million Visa credit card holders in Canada.

The owner of Winners and HomeSense stores warned Thursday that hackers gained access to its computer system and credit card numbers may have been improperly accessed.

Also, a breach involving TJX, the parent of TJ Maxx, Winners and Homesense, may have exposed the personal information of Canadian customers of that store:

globeandmail.com: Computer breach exposes TJX shoppers to fraudSECURITY

Parent of Winners, HomeSense targeted

MARINA STRAUSS AND SINCLAIR STEWART

Tens of millions of credit card customers in Canada and the United States may have been exposed to fraud during a computer security breach at discount retailer TJX Cos., the U.S. parent of Winners and HomeSense.

TJX, which also owns T. J. Maxx and Marshalls, said yesterday it discovered the "unauthorized intrusion" in mid-December and has been working with police and security experts on both sides of the border to investigate the incident and tighten security procedures.

The retailer declined to say exactly how many customers are affected. But sources close to Visa said the company notified banks and other issuers last week that approximately 20 million of its cards around the world may have been involved. Some in the financial industry estimate the number in Canada could be as high as two million. It's not clear how many customers of other credit card companies have been left vulnerable.

The problem was tied to the computer systems that process and store information about customer transactions involving credit cards, debit cards, cheques and merchandise returns -- some of them going back to 2003. The Royal Canadian Mounted Police and the U.S. Secret Service have been called in to investigate.

"While TJX has specifically identified some customer information that has been stolen from its systems, the full extent of the theft and affected customers is not yet known," the Framingham, Mass-based retailer said in a statement.

...

"I was stunned," said retail analyst John Chamberlain at Canadian Bond Rating Service. "That's not what you expect from a big retailer. You really expect that they would have stronger systems than that. You get to the point that you trust a retailer to keep that information."

Customers consider the shopping at TJX stores as a "treasure hunt," never quite sure what they'll find, he said. As a result, customers probably use plastic there more often because they don't always know how much they'll spend, he said.

Company officials didn't return calls. Their statement said the retailer kept the matter secret until yesterday at the request of law enforcement. The company said it promptly notified credit card companies and firms that process customer transactions.

An intruder grabbed information dealing with credit and debit cards sales in TJX stores during 2003 and part of 2006, according to the company. However, a source said that the debit transactions were confined to the U.S. market. TJX has been able to identify "a limited number" of credit card and debit card holders whose information was taken.

Canadian banks are scrambling to assess the potential damage. Tania Freedman, a Visa spokeswoman, said the company is forwarding information to banks. "These accounts were potentially exposed, [but] not all accounts that are exposed will experience fraud," she said, adding that customers are protected by the card's zero-liability policy.

...

In Canada, TJX runs 184 Winners and 68 HomeSense stores.

Expect much more info to come.....

Update (20070118): The Privacy Commissioner of Canada has inititated a complaint on her own accord related to the Talvest breach: Privacy Commissioner launches investigation of CIBC breach of Talvest customers' personal information.

Labels: cardsystems, identity theft, incident, privacy, retail, tjx

![]()

The Canadian Privacy Law Blog is licensed under a

Creative Commons Attribution-Noncommercial-No Derivative Works 2.5 Canada License.